Home Insurance Building and Contents Insurance

Table of Content

Insurance quotes can vary significantly from day to day and according to your individual details, so please just use the following data for educational purposes only; your quotes may reflect a large degree of variation. Additionally, insurance policies across different companies can be difficult to compare directly, as they can vary in terms of excess, cover amounts, etc. Insure with the right sum for both your buildings and contents insurance. If you do not have high value items, consider an ‘indemnity’ contents insurance rather than a ‘new for old’ one. While we are independent, we may receive compensation from our partners for featured placement of their products or services.

Despite timber being a traditional building material, many homeowners with timber-framed properties struggle to secure a policy. At Swinton Insurance, we consider every property for home insurance. Personal possessions — Cover for items that you carry with you away outside your home like keys, smartphones and laptops. Legal protection — Protect yourself from the costs of being sued or claiming against someone else.

What types of Home Insurance are there?

I have endured the most traumatic year of my life without any support from Swinton - despite having three different home insurance policies sold to me by them. Opt for a policy offering No Claim Bonus to lower your premium if you've gone for a few years without making any claim. Has anyone living permanently at the property made any home claim for loss or damage in the past X years or had any claim made against them? Extras you’d like to get on your home insurance, contents sum insured and the excess you’d like to pay. To claim at swinton, you first need to know who your underwritter is (Ageas, Allianz, Aviva, Axa, Broker Direct, Covea, Geo, Integra, LV, L&G, Modus, Ocaso, Prestige or Pen Underwriting).

You may, however, wish to take out a Contents Insurance policy to protect your valuables. Theft by deception - You can’t claim on your policy if you are deceived, like unwillingly handing over your keys to a thief who then steals from you property. Home insurance is not a legal requirement, but if you have a mortgage, it’s likely that your mortgage company has made it a condition of your loan that you acquire at least Buildings Insurance. Construction details - The building materials of structural walls and the roof.

Nursing charting documentation examples

Yet unbeknown to me Swinton facilitated the move to a company that carries out credit checks. Hellosafe.co.uk aims to advise site visitors on insurance and personal finance products in compliance with applicable laws. The information on the hellosafe.co.uk site, although continually updated, may differ from what appears on the providers’ sites. Please consult service providers’ Terms & Conditions for more information.

You may be able to save money by choosing a Combined policy with a single provider rather than taking out Contents and Buildings Insurance separately. Get a direct quote on Home Insurance from Swinton today to find a suitable deal for you. Epic documentation for nurses DOCUMENTATION IN NURSING MAHMOOD AHMED The Epic Quest for Through documentation, nurses communicate to other nurses... Student information management system documentation “Student Information Management System Maharishi Arvind The main purpose of this SRS document is to...

Our Top Insurance Picks

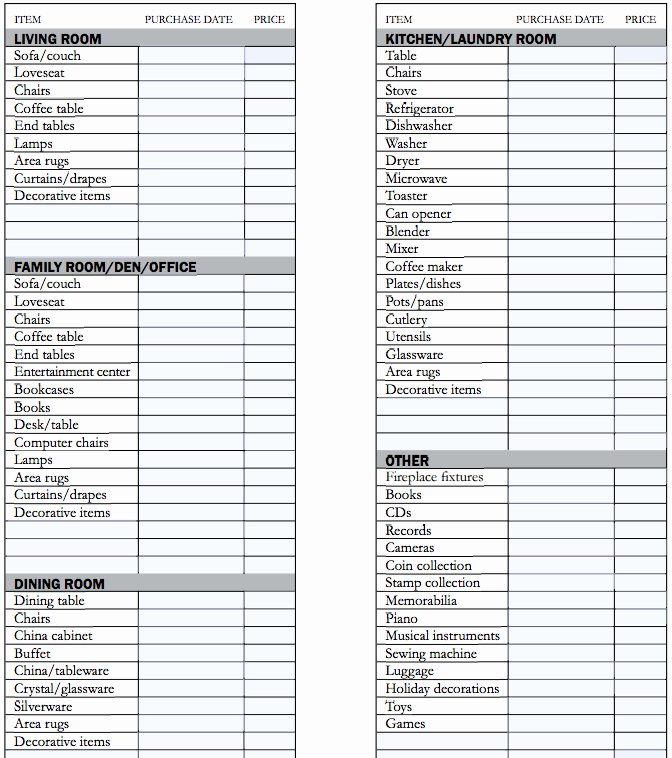

You’ll also be covered for permanent fixtures that can’t be removed, such as fitted kitchens, bathrooms and fitted wardrobes. Contents insurance covers all of the items in your home that don’t make up a part of the building itself. Taking out content insurance prevents you from being hit with a hefty bill to replace your belongings if they are destroyed or stolen.

The art of home building is evolving, creating more properties than ever classified as non-standard construction. From unconventional building materials to futuristic ‘eco-homes’, we work hard to ensure that all homeowners can insure their properties. Accidental damage — Cover for one-off incidents that unintentionally cause damage your property or its contents. You can help make us make a difference, for with every Swinton Home Insurance policy taken out online, you have the option to make a £2 donation. Your kind gift will help provide a lifeline to more people affected by dementia. Combined Insurance allows you to get both Buildings Insurance and Contents Insurance under a single policy.

Home Insurance Reviews

Danny holds a BA in International Business from the University of Plymouth and has undying loyalty to his average-poor football team, Portsmouth FC. Each email is packed full of exclusive money-saving deals, handy hints and tips and news about our latest products and offers. Choosing a higher voluntary excess for your Home Insurance will reduce your premium, but it will require you to pay more if you claim. If you instead decide to pay a lower excess, your premium will be higher, however, your insurer will have to pay more in the event of a claim. Boost security - The safer your property is, the less nervous your providers will be. You can easily reduce the cost of your Home Insurance by installing security equipment and top-of-the-range locks on your doors and windows.

Policy Expert is the UK’s number 1 rated home insurance provider, contents or combined home insurance, Current policy documents. Post Office offers great cover for building and contents with tailored policies for documents and make adjustments to your policy. We found that Swinton home insurance plans are in line with or even less than market averages, depending on the plan. Those looking for cheap cover may even be able to secure a cheap home insurance quote from Swinton for under £200.

I got CCTV at my property and this guy turned up, looked at the wall and left within 2 minutes maybe 3 by a push. Be the first to hear about the best offers, promo codes and latest news. Swinton will establish a risk rate, taking into account all these elements, and offer you a price based on it. Limits mentioned above are part of the total sum you insured with your insurer when applying for home insurance . Applying for home insurance at Swinton will allow you to protect the structure of your home , what is inside or both . Starling Bank has launched its first fixed rate savings product with competitive rate of 3.25% – find out the details here.

Electric bikes offer a real solution to urban transport issues - including recreational and the infamous school run congestion, and yet Swinton doesn't seem to have heard of them. Swinton Insurance refused a claim for damage to roof, even though an independent builder backed up the claim. I believe the refusal to accept the claim was unfair, poor customer service of course, and I would not want to use that company again. Consider index-linked cover for building insurance to follow prices of building materials.

To better understand how Swinton prices compare to the market we gathered pricing data. For the purposes of this exercise, we quoted for a 35-year-old policyholder living in a mortgaged, 3-bedroom property in SN11, who had made no claims in the past 5 years. READ MORE Swinton home insurance reviews can tell you how good this product really is. Our Swinton home insurance reviews can help you to find out this and much more. Swinton home insurance reviews can tell you how good this product really is.

There is a basic “Essential” policy as well as more advanced “Classic” and “Premier” policies. Please note, there is no cover for business-related stock or visitors to your home and any non-clerical business use must always be declared, so please call us if this is the case. Pay upfront - By avoiding instalments, you can avoid being charged additional interest on your payments. Property details - The type of property, number of rooms and when it was built. An experienced team- Our insurance specialists are happy to answer all your questions on Live Chat or over the phone. Home Emergency Cover- Can be purchased as an additional extra to your standard Home Insurance policy.

Home Insurance Guides

Classic offers more coverage features than Essentials; and Premier offers more than Classic. For example, Classic and Premier offer cover for blocked sewer pipes, emergency access, theft from outbuildings, contents in the garden and business equipment. In addition, Premier offers set/suite replacement and student cover. The average cost of combined buildings and contents insurance in 2018 was £163, with contents insurance usually counting for a third of the premium (around £60) and building insurance for the rest (around £110). However, premium will be higher if you buy stand-alone building or contents insurance. Swinton offers buildings insurance, contents insurance or a combined policy which offers a discount.

The lady then calculated the cost of a new policy and gave a discount when I said I had a quote from an online comparison site cheaper. Astonished to hear that electric bikes are not covered by home insurance, despite this being a fast growing and very important transport and fitness option for all ages and abilities. Yet another example of how UK industry lags behind our European neighbours.

Comments

Post a Comment